stock option sale tax calculator

Calculate the costs to exercise your stock options - including. The calculator requires a total of five inputs including.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Open an Account Now.

. The current stock price. Enter the purchase price per share the selling price per share. The Employee Stock Options Calculator.

Non-qualified Stock Option Inputs. New Tax Laws Recently there has. Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut.

January 29 2022. The Stock Option Plan specifies the employees or class of employees eligible to receive options. On this page is an Incentive Stock Options or ISO calculator.

Enter the number of shares purchased. Well break your exercise costs. And if you re-purchase the stock.

Optimize your pricing strategy with real-time market analytics profit trends. Taxes for Non-Qualified Stock Options. Learn How We Can Help.

Ad Were all about helping you get more from your money. The Stock Option Plan specifies the total number of shares in the option pool. The Stock Calculator is very simple to use.

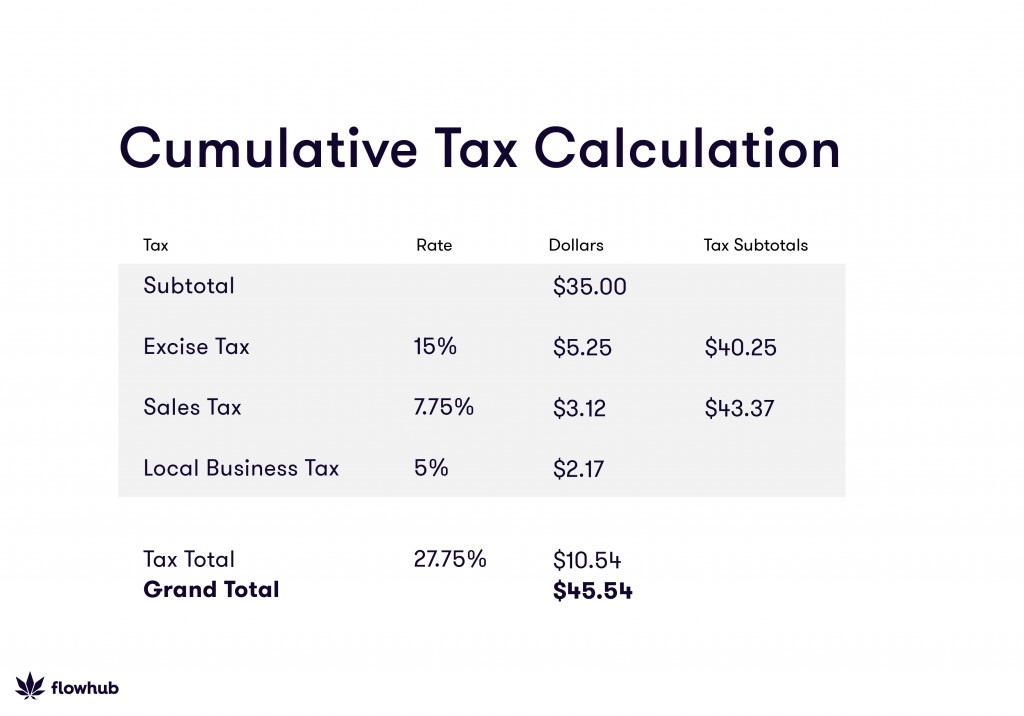

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. There are two types of taxes you need to keep in mind when exercising options. How much are your stock options worth.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Build Your Future With a Firm that has 85 Years of Investment Experience. Capital Gains Tax Calculator.

Lets get started today. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Ad Objective-Based Portfolio Construction is Key in Uncertain Times.

Please enter your option information below to see your potential savings. In our continuing example your theoretical gain is. Ordinary income tax and capital gains tax.

Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. Click to follow the link and save it to your Favorites so. 40 of the gain or loss is taxed at the short-term capital tax.

Your tax amount changes with your companys valuation. 60 of the gain or loss is taxed at the long-term capital tax rates. Exercise incentive stock options without paying the alternative minimum tax.

This calculator also finds your. Ad Achieve predictable profitable outcomes by putting our proven solutions to work. The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained 1000 stock option grants at a strike.

A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the. Section 1256 options are always taxed as follows.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

Lets say you got a grant price of 20 per share but when you exercise your. This permalink creates a unique url for this online calculator with your saved information. When cashing in your stock options how much tax is to be withheld and what is my actual take-home amount.

Exercising your non-qualified stock options triggers a tax. Discover the Power of thinkorswim Today. Enter the number of shares purchased.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. The tool will estimate how much tax youll pay plus your total return on your. For Private and Public Companies Who Want Equity Plans Done Right.

On this page is a non-qualified stock option or NSO calculator. For Private and Public Companies Who Want Equity Plans Done Right. Just follow the 5 easy steps below.

Stock Option Tax Calculator. Taxes can be the most expensive part of exercising your stock options and the most unexpected. This calculator can be used to estimate the potential future value of stock options granted by your employer.

This calculator illustrates the tax benefits of exercising your stock options before IPO. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Cannabis Taxes At Your Dispensary

New York Property Tax Calculator 2020 Empire Center For Public Policy

Locating And Discovering Sales Tax Medical Icon Sales Tax Tax

How To Calculate California Sales Tax 11 Steps With Pictures

Federal Income Tax Calculator Atlantic Union Bank

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

How To Calculate California Sales Tax 11 Steps With Pictures

Need Help And Taxes Text On Stickers With Tax Forms Assistance With Filing Tax Form And Calculation In 2022 Filing Taxes Income Tax Preparation Tax Preparation

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Tax Checklist

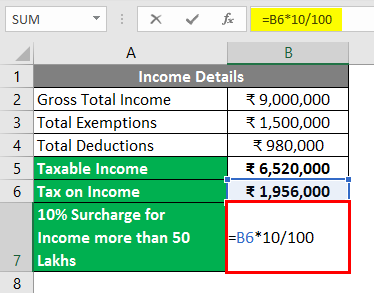

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

End Of Year Inventory Template Calculate Beginning And Ending Inventory Excel Worksheet Excel Spreadsheets Templates Pricing Templates Types Of Taxes

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Calculate California Sales Tax 11 Steps With Pictures

Accounting 101 The Benefits To Your Business Diversity News Magazine Accounting Firms Financial Accounting Accounting

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)